EU Resources on BREXIT

Essential information and resources on Brexit on Brexit & EU Customs Requirements

Brexit Law

EU-UK Withdrawal Agreement

TimeStamp: 12 November 20192019/C 384 I/01:

Agreement on the withdrawal of the United Kingdom of Great Britain and Northern Ireland from the European Union and the European Atomic Energy Community.

Access Resource...Political declaration setting out the framework

TimeStamp: 12 November 20192019/C 384 I/02:

Political declaration setting out the framework for the future relationship between the European Union and the United Kingdom.

Access Resource...BREXIT: The Trade Agreement

Post-Brexit Trade Deal

TimeStamp: 01 January 2021EU-UK Trade and Cooperation Agreement:

The agreement covers not just trade in goods and services, but also a broad range of other areas in the EU's interest, such as investment, competition...

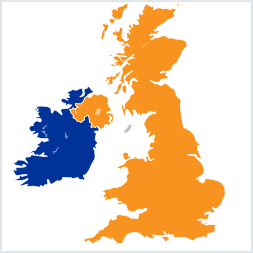

Brexit Trade Agreement...Northern Ireland Protocol

EU-UK Trade AgreementNorthern Ireland Protocol :

The Protocol on Ireland/Northern Ireland, commonly abbreviated to the Northern Ireland Protocol, is a protocol to the Brexit Withdrawal Agreement that covers the special situation in Northern Ireland...

NI Protocol...Brexit Measures for the Transition Period and Beyond

Brexit Readiness Checklist for Companies Doing Business with UK

TimeStamp: 24 August 2020Be ready from 1 January 2021

Scope:

- Provision of services

- Company law and civil law

- Other aspects: data, digital and intellectual property rights

Brexit Checklist for Traders

TimeStamp: 24 August 2020Asses whether your business trades with UK or moves goods through the UK border. If so:

- Talk to your business partners

- Contact your local authorities / advice centres

- Consult the European Commission's website

- Act now !

Brexit: How to Get Ready for the End of the Transition Period

TimeStamp: 24 August 2020EU Guide for Businesses

UK left EU on 31 January 2020. Officially, the UK is no longer an EU country and does not take part in EU decision-making.

During the transition period, rules and procedures for customs and taxation stay the same as before. However, this will change from 1 January 2021.

Access Resource...Preparing for Brexit

French Customs GuidelinesDetailed procedures and Brexit "know-how" with regard to:

- Overview of basic customs procedures

- How Brexit will affect customs

- Preparing your business for Brexit

- Smart border

- Understanding French Customs’ innovative solution

- etc.

European Commission's Brexit Guidances

Guidances for BusinessesThe United Kingdom left the European Union on 31 January 2020.

- Nothing changes for citizens, consumers, businesses, investors, students and researchers in both the EU and the United Kingdom; and

- EU law continues to apply in the United Kingdom.

By the end of 2020, UK’s departure will have serious consequences for public administrations, businesses and citizens as of 1 January 2021.

Access Resource...Getting Ready for the End of the Transition Period

Over 100 Readiness Notices !The Commission is reviewing – and where necessary updating – the over 100 sector-specific stakeholder preparedness notices it published during the Article 50 negotiations with the United Kingdom.

Those notices that have already been updated as ‘notices for readiness’ can be accessed via the resource link.

Access Resource...Wood Packaging & Dunnage

Brexit: Phytosanitary issues With UK Wooden PalletsAll wood packaging material and dunnage from non-EU countries must be:

- either heat treated or fumigated in line with ISPM15 procedures;

- officially marked with the ISPM15 stamp consisting of 3 codes (country, producer and measure applied) and the IPPC logo;

- debarked.

Brexit Consultancy Services

With respect to regulatory Matters & Customs DeclarationsOur consultancy services include:

- Import/Export company procedures overhaul

- Online assistance in fill-in goods movement declarations into Customs IT systems

- Regulatory impact of BREXIT on chemicals trading

- Products and chemical substances assessment

- Supply chain brexit resources assessment

Services Portfolio...EU Customs Databases

TARIC Database

EU Integrated Tariff DatabaseTARIC:

A multilingual database integrating all measures relating to EU customs tariff, commercial and agricultural legislation.

Access Resource...Exporting from the EU / Importing into the EU

One-Stop Imports & Exports SolutionsTrade Assistant: One Stop Database to the EU market's import rules and taxes; and on import duties and taxes to pay on exports to specific countries.

Access Resource...EU EORI Registering Authorities Database

Search on EORI Registering AuthoritiesDatabase on EORI (Economic Operator Identification and Registration Identification) registering authorities from any EU Member State.

Access Resource...EU EORI Numbers Database

EORI Number VerificationDatabase on EU EORI (Economic Operator Identification and Registration Identification) numbers issued by any EU Member State to businesses based in EU.

Access Resource...EU VAT Numbers Database

VAT Number VerificationDatabase on VAT (Value Added Tax) numbers issued by any EU Member State to companies based in EU.

Access Resource...EU Customs Basic Procedures

Applying for an EU EORI Number

From EU Registering authoritiesEU EORI (Economic Operator Identification and Registration Identification) numbers are issued by registering authorities from EU Member State.

Applicants are economic operators either established in the EU, or not.

EU Export Tariffs Database

Tariffs and Rules of OriginDatabase on import duties and taxes to pay on exports to specific countries.

Access Resource...Import Control System 2 (ICS2)

Import Control System 2

ICS2ICS2 is the new EU customs advance cargo information system that will facilitate free flow of trade through improved data-driven customs security processes, adapted to global business models.

It will collect data about all goods entering the EU prior to their arrival. The system will be used by EU customs authorities to ensure security and safety of all people living in the EU

¤ Strengthen protection of EU citizens and the internal market against security and safety threats.

¤ Allow EU Customs authorities to better identify high-risk consignments and intervene at the most appropriate point in supply chain.

¤ Facilitate cross-border clearance for the largest part of legitimate trade.

¤ Simplify the exchange of information between Economic Operators (EOs) and EU Customs Authorities.

More...Useful Links ...

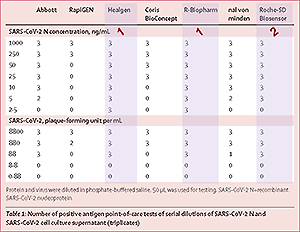

Comparison of seven commercial SARS-CoV-2 rapid point-of-care antigen tests

TimeStamp: April 2021COVID-19 - Best DIY Series :

Seven commercial SARS-CoV-2 rapid point-of-care antigen tests were compared with regard to the analytical sensitivity and specificity.

Access Resource...Appointing a REACH Only Representative

Inquire Service fees & costsB-Lands Consulting Ltd

Central Chambers 45-47 Albert Street

Rugby, Warwickshire CV21 2SG, UK

E-mail: services@reachteam.uk

B-Lands Consulting

27 Rue Pierre Semard

38000 Grenoble, France

E-mail: services@reachteam.eu

Quick Form